Introduction

Operating Income: JPY119.75B (est JPY130.92B)

Pretax Profit: JPY128.61B (vs. Profit: JPY150.33B)

Total Switch Sales: 4.45M Units (-22% Y/Y)

To Buy Back Up To 1.51% Of Shares For JPY100B

Still Sees FY Total Switch Sales: 25.5M Units

On Thursday, Japan's Nintendo Co Ltd 7974.T said it sold 4.45 million units of its Switch console in the April-June quarter, down from 5.7 million a year earlier, in a sign that demand for the hit device may be fading in its fifth year on the market.

The company posted a 17% fall in operating profit to 119.8 billion yen ($1.09 billion), missing the 129.3 billion forecast by nine analysts, Refinitiv Eikon data showed.

The game console maker stuck with its full-year profit forecast of 500 billion yen, lower than an average prediction for 623.5 billion yen from 19 analysts according to Refinitiv.

Software

TIE Ratio (base of consoles between software) was 0.51. This annualized TIE ratio would give us 2x, which is above my estimates for the year considering that there is no major release in 2021 and everything is booked for 22-23. Therefore, from the point of view of software sales per user base, it seems to be an excellent TIE ratio knowing how to understand the business and contextualize it.

If we are critical, we would be talking about a TIE ratio at its lowest point in recent years, but we must bear in mind two key points:

1. Catalyst that the pandemic meant for software sales.

2. There have been no major releases this year.

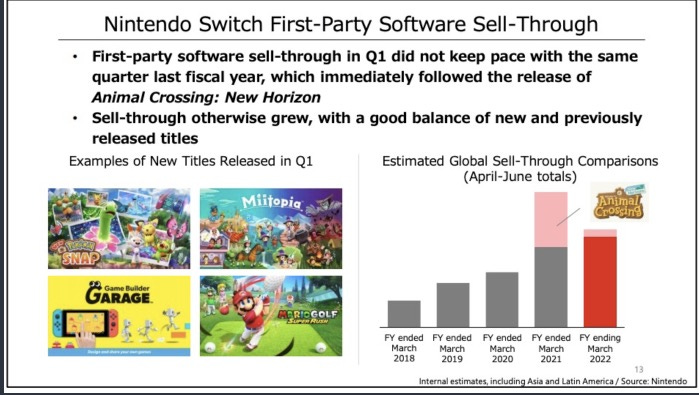

Taking these key points into account, software sales are performing well. This image could resume what I’m talking about:

"Sales of Nintendo Switch software have been strong not only for new titles, but also for titles released in previous fiscal years, and that trend continues. Overall sell-through of first-party software in the first quarter did not keep pace with last year's very high performance when Animal Crossing: New Horizons accounted for 40% of the total. But if we exclude the impact of Animal Crossing: New Horizons, we can see that Q1 sales exceeded those of the same quarter last year."

The pipeline for the rest of the year is more interesting than the first part, so it would be foreseeable that Nintendo's tie ratio would rise above 0.5, leaving us with a tie ratio in 2021 above 2.

Finally, regarding software, Nintendo's digital sales represent 47% of the total. This leaves a huge space for digital sales growth in the sales mix, undoubtedly excellent news.

Companies like Activision, Ubisoft, and EA have more than 80% of their sales via the digital channel, which is more profitable and has better margins than physical.

The Nintendo user is indeed attached to the physical format, but the capacity for penetration and growth in the digital segment is very high.

Hardware

At the hardware sales level, the Switch platform sold an aggregate in Q2 2019 (pre-pandemic) of 2.13M units. In the current quarter they have sold 4.45M.

That's below pandemic sales (normal) but well above unit sales in a normalized year as 2019 was.

Nintendo Switch Lite accounts for 25% of total Switch sales, which is about average. Although it seems to have had a significant drop, it is where it should be: 1 out of 4 Switch sold is Lite.

At the new games level, 233 new games were released in the quarter, which is in the upper mid-range of Switch history.

This is very positive and normal news due to the high user base (89M Switch closure). This leads to an increasing interest from third parties.

Guidance and fast numbers

The guidance is for 25.5M consoles this year which would leave 109M consoles in March 2022.

At the software level, it would be normal to assume a TIE ratio of 2x but in my model I have assumed 1.7x.

On the other hand we must value SWO which is the crown jewel in the future due to its recurrence, mobile IPs and stakes.

These assumptions with the average prices of hard and soft would leave us pricing Nintendo ex-cash at a PE of 13x in 2022.

I sense it will continue to fall due to fear of peak cycle and the low pipeline of games for 2021. The situation will change in 2022-23 with top-tier games coming out which will boost software sales.

In addition to this, the high cash position and the start of a buyback program (something historic in Nintendo) reduce the downside significantly. By 2024 (March 2024), the cash position and dividends collected would represent more than 50% of the Market Cap.

gracias por compartir, muy interesante y gran aportación a la comunidad, os mereceis todos los logros y visibilidad que estais alcanzando, un sector que no conozco, no me gustan los juegos, sabes si está disponible en algún otro mercado aparte del Japones? creo que en Japón minimo son 100 acciones que al cambio son unos 40.000€ o estoy equivocado? gracias